Jet Skiing Tenerife from 89 €. License is not required | Book on-line or call us +34 604 102 196 (WhatsApp)

Season 2024

Jet Ski Tenerife from only 89 €

Hire a jet ski in Tenerife and take a guided tour from Las Galletas at a favorable price. We offer you fascinating jetski safari in Tenerife South at the best price from 89 € per 1 hour and from 129 € per 2 hours.

1-hour safari

For one or two persons on a jet bike

130 € From 89 € free transfer

We offer the best price for jetski rentals in Tenerife if you book at least 2 jet skis. Round trip transfer is already included in the price.

2-hour safari

For one or two persons on a jet bike

160 € From 129 € free transfer

Special offer: 2 hours tour from 129 € for one or 139 € for two people on a jet skiing bike. Round trip transfer is already included in the price.

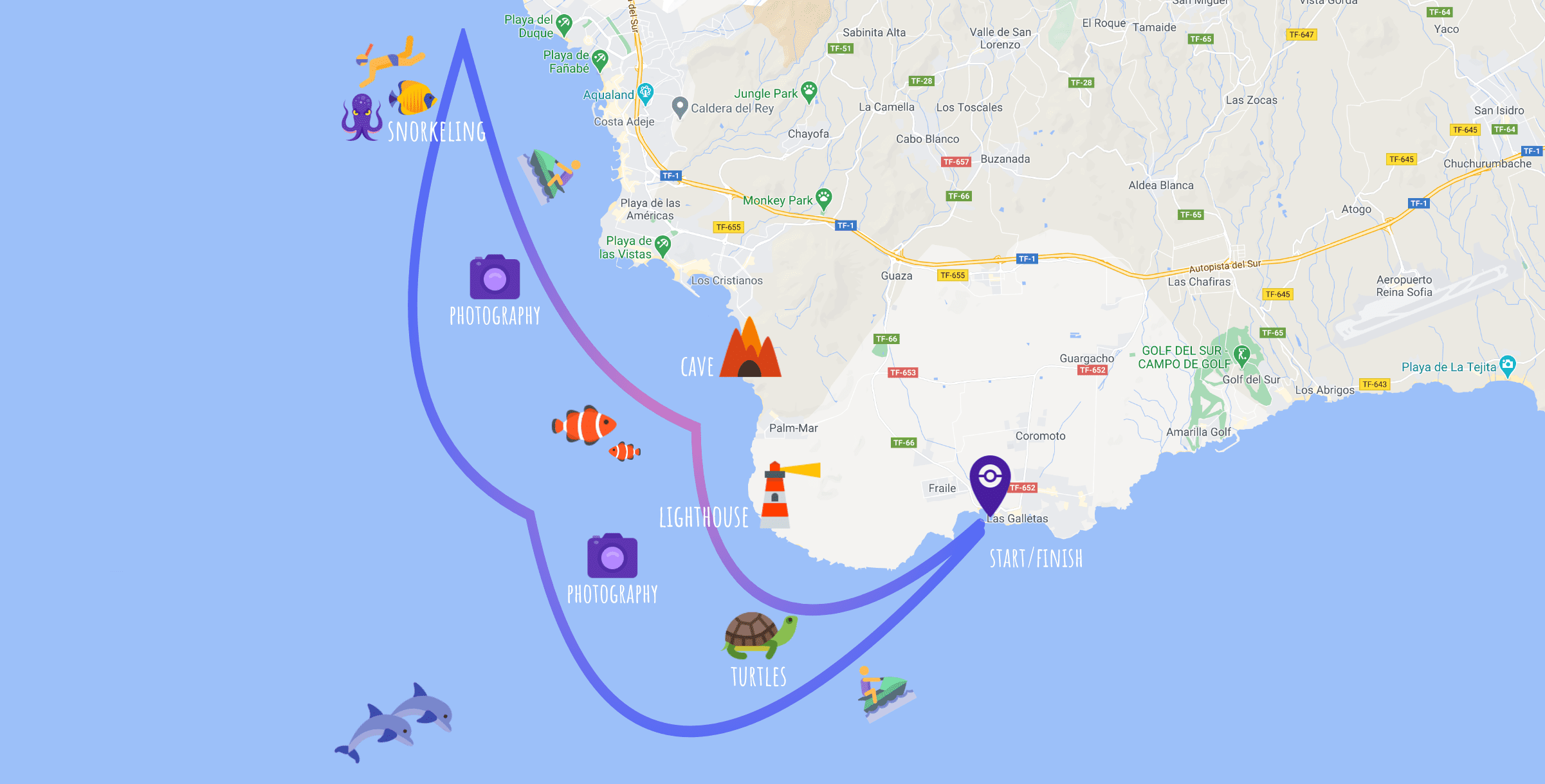

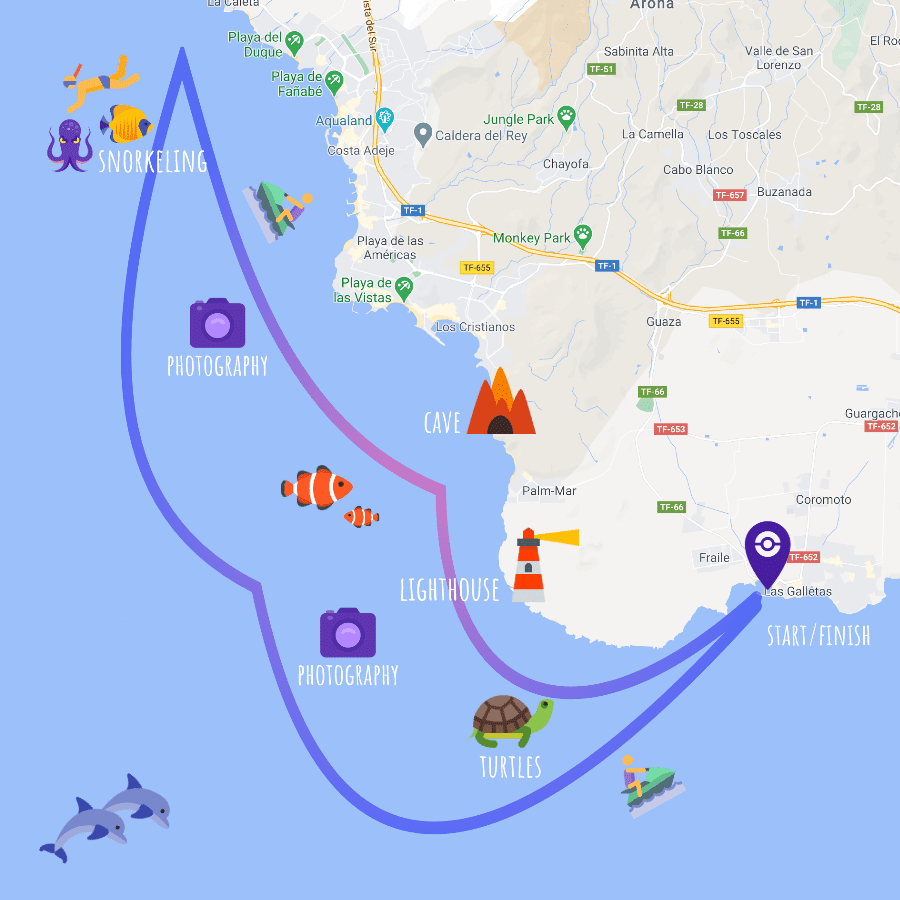

Route map

The route may be changed according to the season and weather conditions in the south of Tenerife.

Reservation

How is it going to be?

- Fill the form in this page and press the button “BOOK NOW”. We will receive your application and contact you to confirm the exact time of the tour and the place where we shall take you from (South of Tenerife area: Playa de las Americas, Costa Adeje, Los Cristianos etc).

- At the agreed time, our minibus will pick you up from an appointed place. Upon arriving at the port Las Galletas, you will be able to pay your jet ski tour, change clothes and leave your stuff in a special storage place for your excursion time.

- We will provide you with a relevant life jacket and explain the safety briefing. Now, you are ready to go jet skiing.

- By breaking ocean waves surrounded by rainbow in the cloud of splashes, you will embark on a voyage of discovery of Tenerife from a new perspective. You will enjoy seeing the National Park Teide, coastline cliffs, inaccessible caves, cozy bays, and beautiful marine world.

- In the middle of our jet skiing safari in Tenerife, we will make a stop to have rest and explore the underwater world while snorkeling (2-hour tours only). If two of you share a single jet skiing bike, you can switch places after this stop.

- After restoring and snorkeling with masks, we will embark on the return voyage.

- After arriving at the port, you can look at pictures of your trip and purchase them.

- When you are ready for a trip after having changed clothes, our minibus takes you back to your hotel or apartments. Of course, you can stay in Las Galletas to have rest after the excursion and visit one of local fish restaurants.

The driving license IS NOT required

The minimum age for independent driving a jet ski in Tenerife is 18. Persons above the age of 16 can ride in the company of adults.

Free transfer

We provide free round-trip transfers in the south of Tenerife, from Callao Salvaje to Golf del Sur (including Playa Paraiso, La Caleta, Adeje, Las Americas, Los Cristianos). Transfers from other locations are by prior arrangement, additional fees may apply.

Snorkeling

Combine your jetski safari in Tenerife with discovery of the wonderful underwater world of the Atlantic Ocean. Within the 2-hour excursion, we provide you with new snorkeling masks which make your diving and breathing more comfortable (without a tube in your mouth). These masks provide a wide view and are equipped with an antidim system.

Photographies

During a tour, we will take pictures. After the tour, you can purchase pictures, which will remind you of vivid emotions of your vacation and sunny Tenerife. We use a professional camera what ensures quality photos and unforgettable memories.

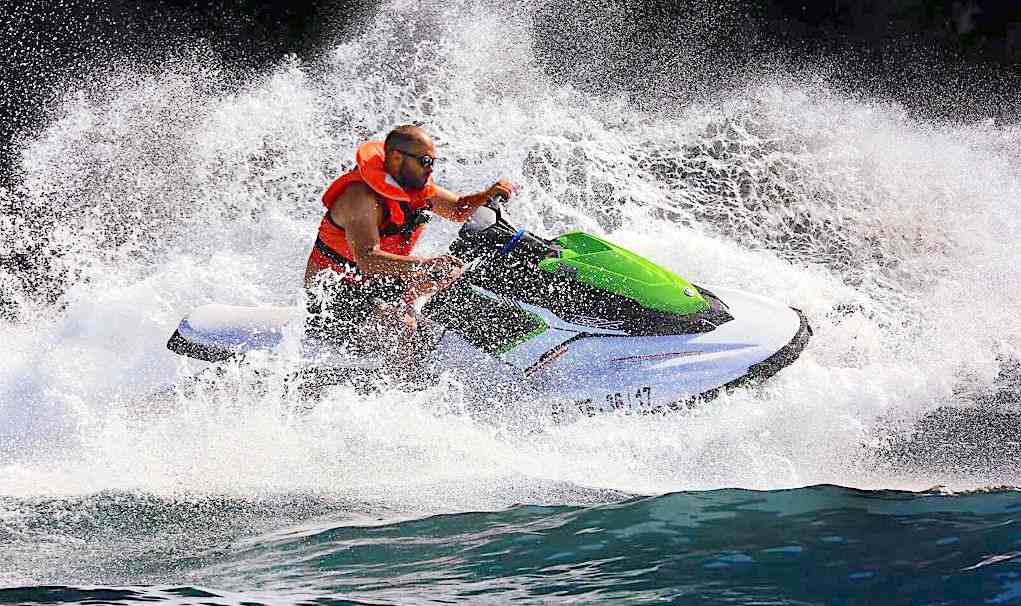

Comfortable and powerful Jet Bikes Yamaha and Sea-Doo

During a ocean jet ski safari, you can enjoy the power, comfort and safety of the best Yamaha and Sea-Doo water scooters. Smooth lines and high quality of materials make these water bikes beautiful and very fast and, what is the most important, comfortable for you. Our jet bikes are equipped with engines with the power of 110-130 h.p. IMPORTANT: The total weight of the jet ski passengers must not exceed 160 kg.

Also, we provide

- A safe place for storing your effects (clothes, phones, values etc.)

- Fresh water

- Sun protection accessories

- Wetsuits in case of the cool weather)

Answering your questions

Of course! When booking a jet ski safari you can ask for free transfers from Costa Adeje, Playa de Las Americas, Los Cristianos and other places in the south of Tenerife.

Please contact us +34 604 102 196 or through WhatsApp (press to start the chat) and we will do our best to help you.

Yes, if you reserves more than 4 jet bikes. Please, contact us to be given a personal offer.

We have special lockers for clothes and values of our clients.

If your circumstances have changed and you cannot take part in the safari or you want to change the time and date, please, preliminarily notify our manager +34 604 102 196 or through WhatsApp.

Of course. In the middle of the route, we make a stop to have rest and snorkeling. After this, you can switch places.

It is very easy to control the jet ski, you have the accelerator handle to speed up. To slow down, just release it.

Sometimes the dolphins themselves approach the boats or groups of jet skis. But, according to the rules governing jet-ski safaris in Tenerife, we must not purposely approach them, chase or in any other way disturb the animals.

Customer reviews

Brilliant time!

⭑⭑⭑⭑⭑

Staying in Playa de Las Americas, we had a brilliant time with jet skies. The service was excellent and Lazlo was a great guide. Jumping off the jet bike and swimming in the deep blue ocean was one of the highlights for me. Real adrenalin, fun-packed hour supervised by the helpful and friendly Lazlo. I would recommend it.

Robert Feather

Amazing jetski session with Adolfo

⭑⭑⭑⭑⭑

We had a 1-hour jet ski safari with my girlfriend. That was just amazing: 50 km/h on an empty flat sea, with the infinite ocean on one side and the impressive mountains on the other. Adolfo was creating waves for us so that we could have fun riding them. I would definitely go back and recommend people to go there! We were warmly welcomed and felt just at home.

Jesper Simmelsgaard

About Tenerife Jet Ski Safari

Jet ski safari in Tenerife is great entertainment and sport for the whole family, especially since a driver’s license is not required. You will get acquainted with the sea inhabitants of the Atlantic coast of Tenerife and, of course, get unforgettable emotions and memories for a lifetime.

Jet skiing Tenerife is one of the most popular activities, therefore, during high season, try to book a jetski Tenerife in advance to be able to choose the most convenient time.

We offer Tenerife jet ski safari for 1 hour for beginners and 2 hours for those who are 100% confident in their abilities. At your disposal are modern models of Seadoo and Yamaha jet bikes which certainly meet the highest requirements for comfort and safety.

Also all jetski tours include a shuttle service from your hotel in southern Tenerife (Costa Adeje, Playa de Las Americas, Los Cristianos) to the starting point of the jet ski safari in Las Galletas (Tenerife South) and back.

In addition, our jet ski tours include a snorkeling stop. You can swim with a mask and see different types of fish, stingrays and sea turtles. Of course, in the winter season, when the water temperature is about 19 degrees, for all participants of the safari, we offer jet ski wetsuits, so that you will be comfortable in any weather.

During a jet-skiing safari, our employee will take a picture of you at the jet ski in the spray of the waves of the Atlantic ocean. So you will be able to view and purchase these photos after the trip.

We appreciate that our customers are always satisfied with the sea trip, re-order for the next year and especially recommend jet ski Tenerife to friends.

A little more: we also offer other activities in Tenerife: kayaking, yacht tours and fishing. You might also be interested in visiting a cannabis club in Barcelona. Whatever you choose, enjoy your trip to sunny Spain!

Jet Skiing Tenerife Team